Yrityskauppasi strateginen kumppani

MBO Partners hoitaa yrityskauppasi ja rahoitusjärjestelysi aina taustavalmisteluista kauppojen solmimiseen asti.

Toimintamme laatu perustuu pitkään kokemukseen ja vahvaan näkemykseen sekä luovaan ongelmanratkaisukykyyn. Palvelumme ovat aina ehdottoman luottamuksellisia. Asiantuntijoillamme on pitkä käytännön kokemus operatiivisesta liiketoiminnasta, sen johtamisesta ja hallitustyöskentelystä.

Palvelemme asiakkaita pörssiyhtiöistä pk-yrityksiin. Tyypillinen asiakas on kuitenkin yrittäjä, jonka yrityksen liikevaihto on 3–50 miljoonaa euroa.

Tarjoamme monipuolista osaamista

Räätälöimme palvelumme vastaamaan aina asiakkaamme tarpeisiin ja toteutamme toimeksiannot tiiviissä yhteistyössä asiakkaan kanssa. Näin kykenemme tarjoamaan asiakkaillemme kokonaisvaltaista palvelua, jonka päätavoitteena on löytää asiakkaan yritykselle sopivin ratkaisu, jolla pääsemme sekä taloudellisesti että liiketoiminnan jatkamisen kannalta parhaaseen mahdolliseen lopputulokseen.

Palveluihimme kuuluvat mm. yritysten myynnit ja ostot, MBO-kaupat, yrityksen arvonmääritys, sukupolvenvaihdokset, muut rahoitusprojektit, käänneyhtiöiden palvelut sekä omistajien sparraus.

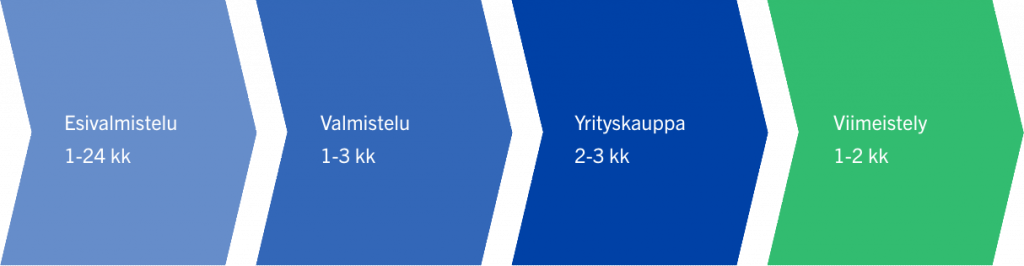

Yrityskaupan ajankäyttö

MBO Partners Oy

MBO Partners Oy on vuonna 2003 perustettu yrityskauppoihin ja -järjestelyihin erikoistunut asiantuntijayritys, joka on ollut mukana toteuttamassa yli sataa yrityskauppaa ja rahoitusjärjestelyä.

Tärkeimpiä toimintaamme ohjaavia arvoja ovat yrittäjyyden arvostus, innovatiivisuus, näkemyksellisyys ja luottamuksellisuus. Tunnemme yritystoimintaan liittyvät haasteet ja ymmärrämme yrityksen merkityksen omistajalleen. Tällöin liiketoiminnan jatkuminen voi olla hyvinkin tärkeää yrityksestään luopuvalle omistajalle. Oikea jatkaja voi löytyä täysin uudelta alalta, mikä alleviivaa innovatiivisuuden ja monipuolisen kokemuksen merkitystä. Uskallamme myös tuoda näkemyksemme esille ja kertoa asiakkaillemme, milloin yritysjärjestelyyn ei ole kannattavaa ryhtyä.

Kaikessa toiminnassamme korostuu luottamuksellisuus. Jokainen yritysjärjestely on yksilöllinen prosessi, joka vaatii perusteellista perehtymistä asiakkaan yritykseen ja markkina-asemaan. Prosessimme ovat aina täysin luottamuksellisia, mikä mahdollistaa avoimen tiedonkulun meidän ja asiakkaamme välillä.